2021 Federal Unemployment Wage Base

In this article we ll help you understand 2021 and 2020 wage bases and limits and how to update them for.

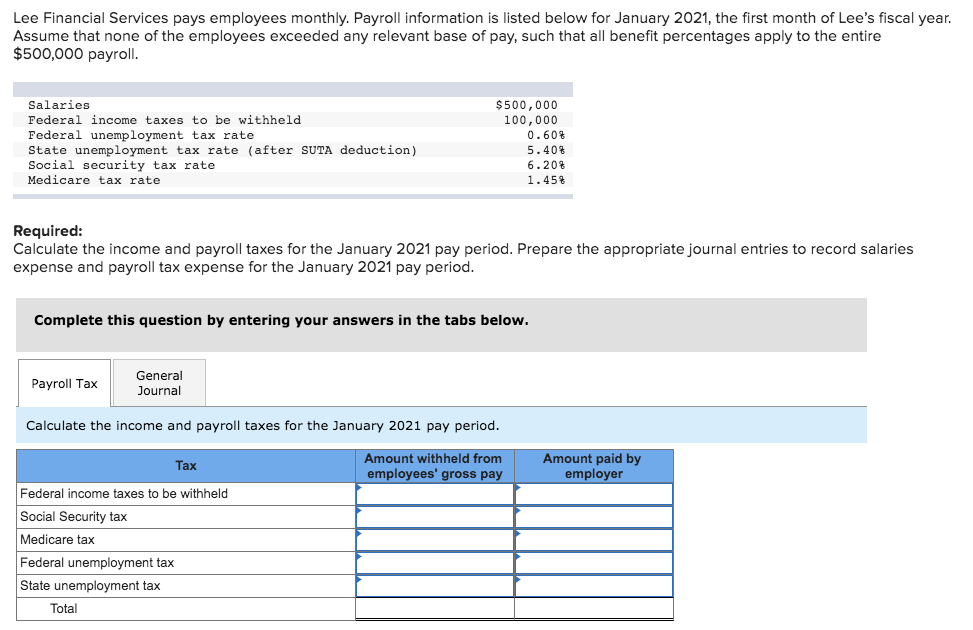

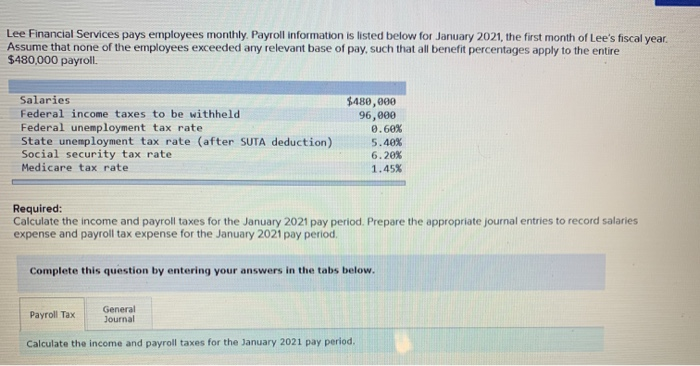

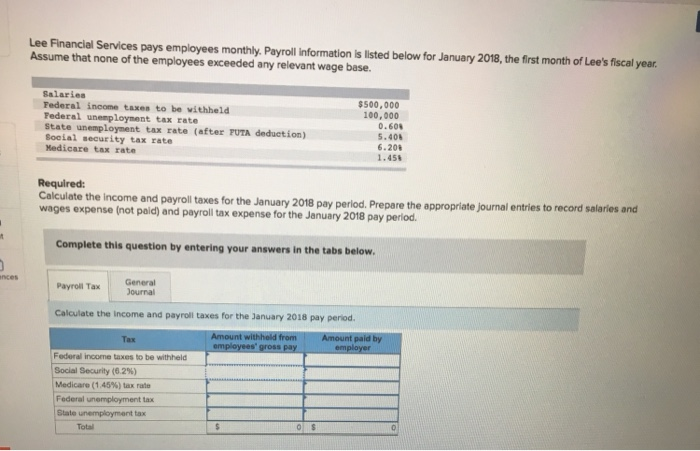

2021 federal unemployment wage base. An employer who is in a state that required a title xii advance in calendar year 2020 will likely see a federal unemployment tax act futa credit reduction in the year 2022 assuming that loan balance is still outstanding as of nov. Provides wage supplements for eligible reemployed workers age 50 and over whose reemployment resulted in lower wages than those earned in their trade affected employment. Futa requires that each state s taxable wage base must at least equal the futa taxable wage base of 7 000 per employee and most states have wage bases that exceed the required amount.

The employer rate for these taxes is determined by the state and sent in a notice in july. Federal and state payroll updates 2021 onpay we make it easy to switch and now s the best time. The tdi taxable wage base for employers only is 36 200 a slight increase from 2020 s 35 300.

Nj unemployment and disability. 2021 state wage bases updated 11 05 20 2020 state wage bases 2019 state wage bases 2018 state wage bases. The tax rate for existing employers for the state plan is based on each employer s claims experience.

Federal unemployment benefits and allowances. For 2021 the employer base for unemployment and disability increases from 35 300 to 36 200. A 10 percent tax on a 7 000 wage base raises 700 while the same rate on a 49 800 wage base generates 4 980.

Understand annual wage base limits. Look here to see any 2021 federal and state changes in minimum wage state unemployment wage bases and paid leave laws. The unemployment base for the employee will increase from 35 300 to 36 200 while the rate will remain the same at 425.

Currently washington is the state with the highest taxable wage base at 52 700 rates can only be understood in tandem with wage bases. A wage base limit is a per employee cap on the earnings that are taxable.