2021 Federal Unemployment Tax Rate

2021 tax rate notices have been postponed if you are a taxpaying employer we normally send you a tax rate determination in the mail every december.

2021 federal unemployment tax rate. We also post that tax rate determination in your online account. If you re entitled to the maximum 5 4 credit the futa tax rate after credit is 0 6. Consequently the effective rate works out to 0 6 0 006.

10 12 22 24 32 35 and 37 there is also a zero rate. If the employer is eligible for the maximum credit it means that the tax rate will be only 0 6 i e. The employers can claim this maximum credit of 5 4 if they satisfy both the conditions below.

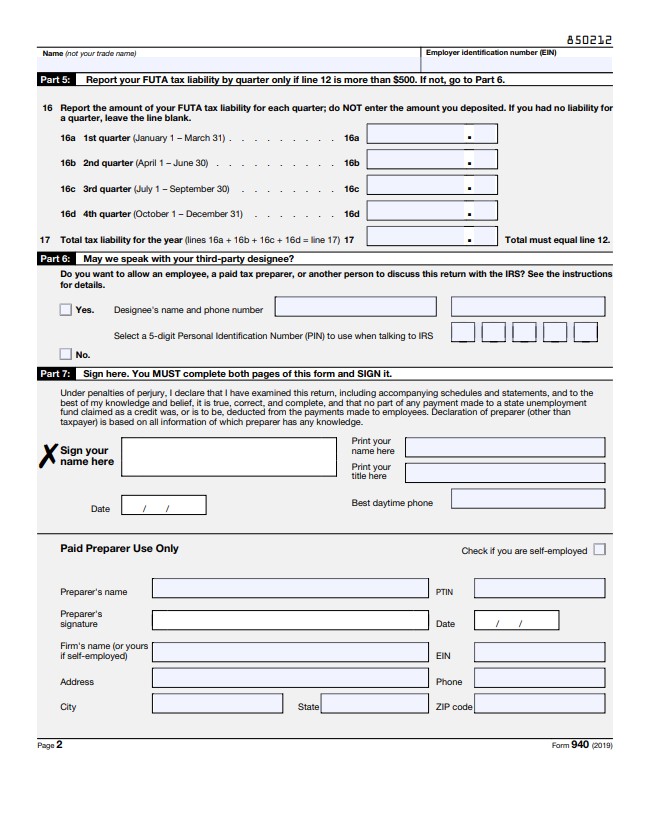

Effective january 1 2021 unemployment tax rates for experienced employers are to be determined with schedule f. For social security the tax rate. The futa tax is 6 0 060 on the first 7 000 of income for each employee.

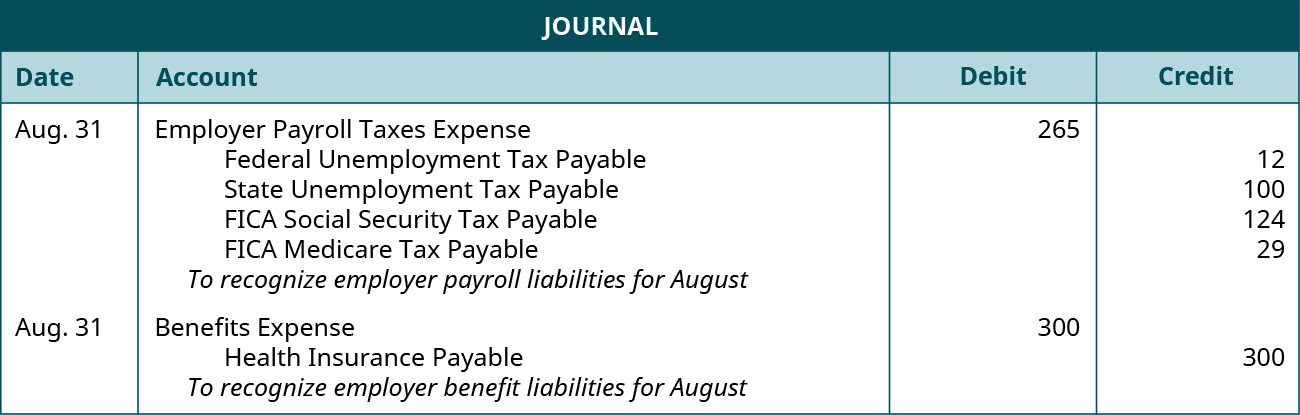

Paid state unemployment taxes on time in full. Generally if you paid wages subject to state unemployment tax you may receive a credit of up to 5 4 when you file your form 940. An employer who is in a state that required a title xii advance in calendar year 2020 will likely see a federal unemployment tax act futa credit reduction in the year 2022 assuming that loan balance is still outstanding as of nov.

There are still seven 7 tax rates in 2021. The futa tax is mandatory to pay for employers who meet the conditions and form 940 2021 employer s annual federal unemployment tax return must be filed to report futa taxes annually. There is also suta state unemployment tax.

The 7 000 is often referred to as the federal or futa wage base. As a result tax rates for experience rated employers will continue to range from 1 50 to 6 20. Most employers receive a maximum credit of up to 5 4 0 054 against this futa tax for allowable state unemployment tax.