Nj Unemployment Tax Rate 2021

The tax rate for existing employers for the state plan is based on each employer s claims experience.

Nj unemployment tax rate 2021. There is no employer match for the additional medicare tax. The employer rate for these taxes is determined by the state and sent in a notice in july. The maximum social security tax deduction for employees is 8 853 60.

2021 alternative earnings test amount for ui and tdi. 2021 base week amount. The wage base remains at 7 000.

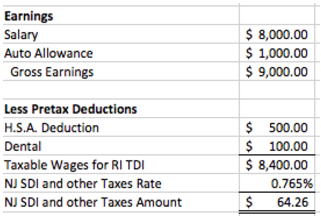

For 2021 the employer base for unemployment and disability increases from 35 300 to 36 200. Explanation of federal unemployment tax act futa. The unemployment tax rate for new employers in fiscal 2021 is 2 8 unchanged from fiscal 2020.

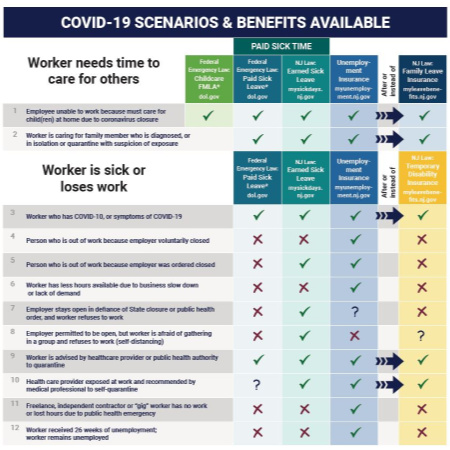

2021 maximum workers compensation weekly benefit rate. Effective from july 1 2020 to june 30 2021 unemployment tax rates are determined with table b the department said on its website. A 0 9 additional medicare tax must be withheld from an individual s wages paid in excess of 200 000 in a calendar year.

Family leave insurance tax rate for employees rises to 0 28 of taxable wages up from 0 16 in 2020. 2021 maximum unemployment insurance weekly benefits rate. Nj unemployment and disability.

The general unemployment tax rate for new employers is to remain at 2 80 during this period. Outside of payroll taxes legislation signed into law in 2020 also reinstated the 2 5 corporate business tax surcharge that originally had been scheduled to be reduced to 1 5 for the 2020 tax year. The unemployment base for the employee will increase from 35 300 to 36 200 while the rate will remain the same at 425.